Retirement Refinance

Leverage higher interest rates to your advantage

A retirement refinance could help you lock in higher initial bonuses, create greater growth opportunities, and secure a source of guaranteed lifetime income with a fixed indexed annuity (FIA).1 This is an opportunity not seen in the last 20 years.

Mortgage refinance: A familiar story

Many homeowners have refinanced their mortgages one or more times to secure a lower interest rate and save money.

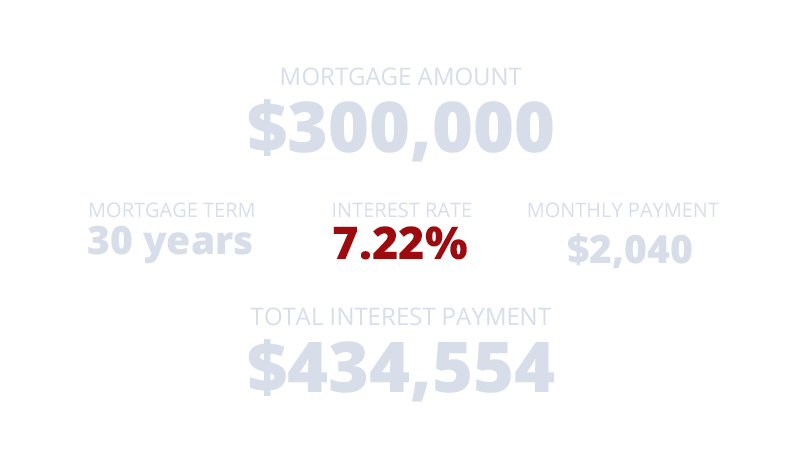

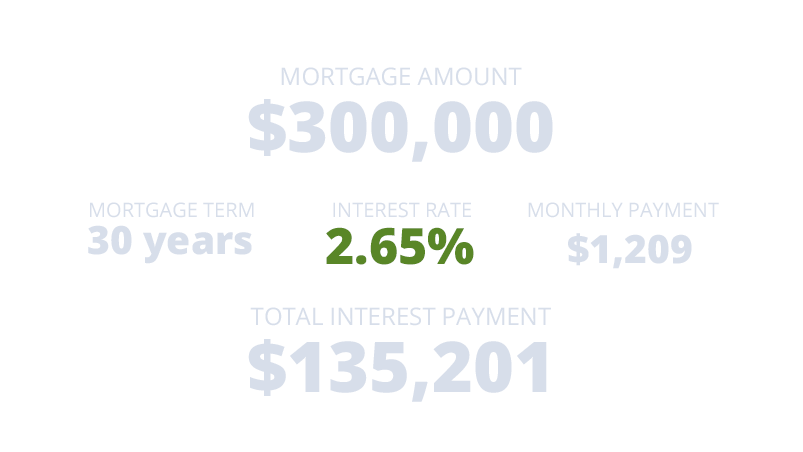

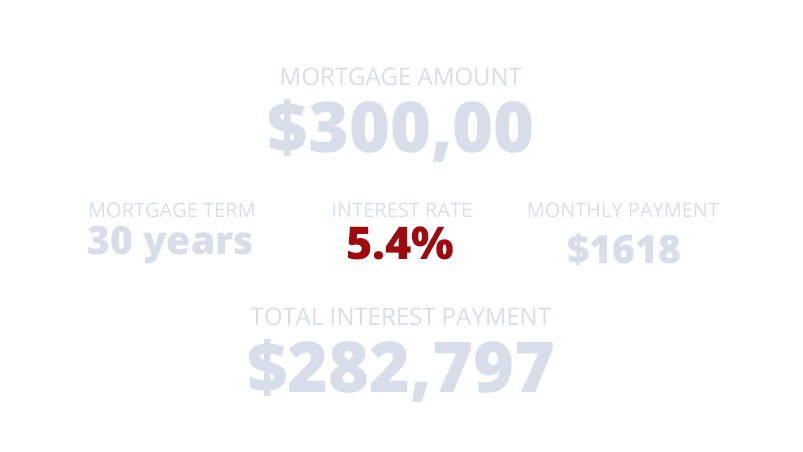

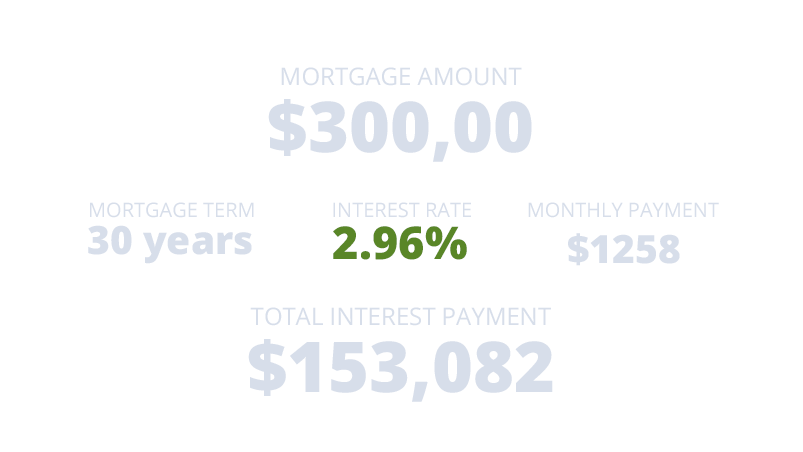

Declining rates drove mortgage refinancing

Interest rates dropped steadily from 2000 to 2021, causing homeowners to rush to refinance their mortgages and save on monthly payments.

See the impact of lower ratesSource: Freddie Mac PMMS Archives

Source: Freddie Mac PMMS Archives

Since 2020, interest rates have risen over 400%

Over the last four years, interest rates have risen substantially, creating a unique opportunity for retirees seeking to optimize their retirement plans.

THE

BOTTOM

LINE

While today’s high interest rates aren’t ideal for mortgage refinancing, annuity policyholders can take advantage of the higher rates to “refinance” their retirement plans for the better.

How a retirement refinance works

Today’s higher interest rates can actually be a huge benefit to your retirement portfolio. For annuity owners specifically, today’s higher rates translate into higher participation rates, bonuses, and guaranteed income levels.

Fixed Indexed Annuities offer protection from a market downturn, a growth opportunity through diverse indices, and an opportunity for guaranteed income for life.1

Retirement refinance considerations

When to consider exchanging into a new policy

When to consider keeping your existing policy

3 potential benefits of upgrading your Fixed Indexed Annuity

Significantly higher participation rates2

The Participation Rate is the percentage of the index return that gets credited to a Fixed Indexed Annuity (FIA) contract. Today’s FIA participation rates are much higher than in the past. On some products, you can now receive up to 200%–350%, meaning the annuity could credit 2-3.5 times the index return.4

See an example

Premium bonuses are at record-high levels3

A premium bonus is immediately credited to your contract when you purchase the annuity and is based on a percentage of your premium deposit. Today’s initial premium bonuses are 10-20%, some of the highest in the history of fixed indexed annuities.

See an example

Generate guaranteed income for life1

Many people need more than Social Security and savings to provide for their daily needs in retirement. Annuities are unique in that they are one of the only products that can provide guaranteed income for life no matter how long you live. Today’s Income Base Bonuses can be as high as 30% and the guaranteed annual roll-up rates are up to 8%.

See an example

YOUR

NEXT

STEPS

To explore your retirement refinance opportunity, speak with your insurance or financial professional today.

1 All guarantees are subject to the claims paying ability of the insurer.

2 For each annuity, participation rates, fees, charges, and/or spreads (if applicable) vary by carrier and have an impact on realized product performance. Participation rates can be above or below 100%. Insurance carriers are authorized to decrease or increase participation rates at their discretion, which could lower or raise product returns over time. High participation rates are not a guarantee of future performance and rely on underlying index performance. Annuities are not direct investments in indexes.

3 Premium bonuses may be subject to a premium bonus recapture. Products that have a premium bonus may offer lower credited interest rates, lower index cap rates, lower participation rates and/or greater index margins than products that do not offer a premium bonus. Over time and under certain scenarios, the amount of the premium bonus may be offset by the lower credited interest rates, lower index cap rates, lower participation rates and/or greater index margins.

4 Interest credited may be limited by yield caps, spreads, or strategy charges.

This information is not a recommendation to buy, sell, hold, or rollover any asset, adopt a financial strategy or use a particular account type. It does not take into account the specific investment objectives, tax and financial condition or particular needs of any specific person. You should work with a financial professional to discuss your specific situation.

Fixed Indexed Annuities are not a direct investment in the stock market. They are long-term insurance products with guarantees backed by the claims-paying ability of the issuing insurance company. They provide the potential for interest to be credited based in part on the positive performance of an index or blend of indexes while protecting from downside market risk. Fixed Indexed Annuities may not be suitable or appropriate for everyone.

Fixed Indexed Annuities are long-term, tax-deferred vehicles designed for retirement. They are not intended to replace emergency funds, to be used as income for day-to-day expenses or to fund short-term savings goals. Please read the fixed indexed annuity contract for complete details.

Although Fixed Indexed Annuities guarantee no loss of premium due to market downturns, deductions from the accumulation value for optional benefit riders or strategy fees or charges associated with allocations to enhanced crediting methods could exceed interest credited to the accumulation value, which would result in loss of premium.

Withdrawals may be subject to federal and/or state income taxes. An additional 10% federal tax penalty may apply if you make withdrawals or surrender your annuity before age 59½. You should consult a tax advisor regarding your specific situation.

Withdrawals taken during the surrender charge period above the penalty-free amount will be subject to surrender charges and possibly a market value adjustment. A market value adjustment is applied only during the market value adjustment period to full surrenders and to any partial surrender in excess of the penalty-free partial surrender amount.

ANNUITES ARE NOT GUARANTEED BY ANY BANK NOR INSURED BY FDIC OR NCUA/NCUSIF. MAY LOSE VALUE. NO BANK/CREDIT UNION GUARANTEE. NOT A DEPOSIT. NOT INSURED BY ANY FEDERAL GOVERNMENT AGENCY. MAY ONLY BE OFFERED BY A LICENSED INSURANCE AGENT. All guarantees are subject to the claims-paying ability of the insurance company.